| Loan balance after the ith payment | ||

|---|---|---|

| principal or initial loan balance | ||

| Interest rate | ||

| Loan term | ||

| Loan product, important parameter which fully specifies a loan | ||

| Number of loan payments | ||

| Time between loan payments | ||

| Helpful collection of variables | ||

| Fraction of loan term | ||

| Repayment rate (dollars per time) | ||

| Fraction of payment to interest during the ith payment | ||

| Fraction of initial payment to interest | ||

| Total payment to interest | ||

| Sum of all payments | ||

| Overpay ratio |

Photo credit to Donald Trump

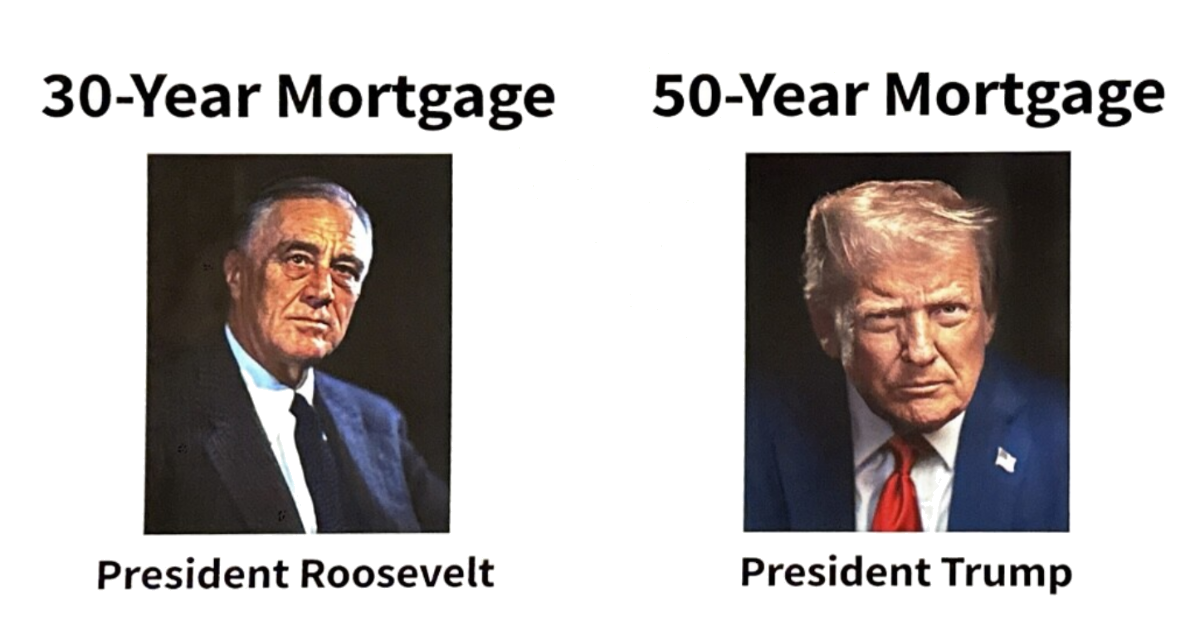

In the article on interest as a function of one variable, I showed how the payment rate reaches an asymtote as the loan term increases. This is the "interest only" limit, where 100% of the borrowers payments are used to cover the interest and the principle never declines. Here I will explain how this limit prevents 50 year mortgages from increasing affordability compared to 30 year mortgages in most cases.

On November 8th, 2025, Donald Trump posted an announcement of 50 year mortgages to his Truth Social account. What exactly was meant by this was unclear but depending on the source, it either meant that Fannie Mae and Freddie Mac would start buying 50 year mortgages, that the government would start issuing them directly, that the president would pressure banks to offer them through a variety of coercive means, or that it meant nothing and he was just trolling.

As of this writing, nothing has come of it, but it is nonetheless interesting to figure out exactly how much effect this could have on housing affordability.

No matter how long the loan term is, the payment rate will always be greater than the interest rate.

To get a sense of this limit in action, we can compute the loan term as a function of interest rate and the ratio between the repayment rate and the interest-only repayment rate (\(P_\text{int-only} = rB_0\)).

This allows us to recreate the graph of repayment rate vs loan term from here and add red dots where the ratio of the repayment rate to the interest only rate is fixed at 95% (ie \(P_\text{int-only}/P = 0.95\)).

[Caption] At higher interest rates, the repayment rate approaches the interest only rate faster.

This graph shows that at higher interest rates, when politicians are under the most pressure to increase affordability, increasing loan terms has the smallest effect.

Another way to look at this is to directly plot \(t_\text{term}\) vs \(r\) for a fixed ratio of \(P_\text{int-only}/P = 0.95\). In the case of 30 vs 50 year mortgages, we can directly compare the repayment rates assuming equal interest rates.

[Caption] [Left] Plot of \(t_\text{term}\) vs \(r\) for a fixed ratio of \(P_\text{int only}/P = 0.95\). [Right] Plot of \( P_\text{50 year}/P_\text{30 year}\) vs \(r\). As of this writing in 2026, interest rates are at 6-7% so shifting from a 30 year to 50 year mortgage can only save approximately 10-13% on the monthly payment.

Everything in the previous section assumed equal interest rates. Longer loan terms always command higher interest rates. Between a 15 and 30 year mortgage, the interest rate is 0.5 to 0.7% higher. Let's recreate the plot of the \( P_\text{50 year}/P_\text{30 year}\) assuming a similar gap in interest rates.

[Caption] Plot of \( P_\text{50 year}/P_\text{30 year}\) vs \(r\) where \(r\) is the rate on the 30 year mortgage and the rate on the 50 year mortgage is greater by between 0.1% and 1.0% as indicated by the colorbar to the right.

At our current interest rates, 6-7%, and assuming a 0.5% higher interest rate on 50 year mortgages, the difference in repayment rate is a less than 5%. If the interest rates climb to 9% or the difference between a 50 and 30 year mortgage reaches 0.8% (at todays 7% interest rates), the payment on the 50 year mortgage will be higher than on the 30 year. This will not help anyone.